does texas have a death tax

There is a Federal estate tax that applies to estates worth more than 117 million. So long as the decedents estate is valued at less than the applicable exemption amount for the.

How Will The Changes In Property Tax Laws Affect Texas Landowners Paramount Property Analysts

Most Texans dont have to worry about the death tax.

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Does Texas have an inheritance or estate tax. A surviving spouse between the ages of 55 and 65 can keep the decedents exemption by applying at their local tax appraisal office.

Only an estimated 489 percent of Texas households have a net worth of one million dollars or more and that number. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. There is a 40 percent federal tax however on estates over 534.

Only 12 states plus the District of Columbia impose an estate. On a state level Texas is one of 38 states that does not impose an estate tax or death tax and as of 2015 Texas no longer collects. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a 40 percent federal tax however on estates over 534. Before that law was enacted the exemption was 549 million per person for decedents who. Prior to September 15 2015 the tax was tied to the federal state.

Texas repealed its inheritance tax law in 2015 but other. Texas does not have an. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. The 2017 tax reform law raised the federal estate tax exemption considerably.

Death sentences have remained in the single digits for the past six years. The only types of. A transfer on death deed has no legal effect during the owners life so state ad valorem property tax.

What are the state and federal tax consequences of a Texas TODD. No there is currently also no inheritance tax in Texas for individuals who died. Death Taxes in Texas Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015.

No not every state imposes a death tax. Does texas have a death tax Friday July 1 2022 Edit. Then the estate must pay the taxes interest and penalties.

Texas is one of the states that do not collect estate taxes. No Texas does not have an estate tax for the time being anyway. New death sentences in Texas have decreased since peaking in 1999 when juries sentenced 48 people to death.

After the homeowners death if the. Does Texas have an inheritance tax.

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

Politifact Texas Property Taxes And The Death Penality Texas Standard

Inheritance Tax Here S Who Pays And In Which States Bankrate

:watermark(cdn.texastribune.org/media/watermarks/2016.png,-0,30,0)/static.texastribune.org/media/images/2016/01/28/marijuana_stamps.jpg)

Analysis The Death Of Taxes On Illegal Drugs In Texas The Texas Tribune

Texas Attorney General Opinion Ww 1134 The Portal To Texas History

Texas Estate Tax Everything You Need To Know Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/dmn/XON2HRNKLFDBLM6ZDNGOYDTUVQ.png)

Death And Taxes The Imperiled Federal Estate Tax Exemption

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Is There An Inheritance Tax In Texas

Texas Supreme Court Holds That A Beneficiary May Not Accept Any Benefit From A Will And Then Later Challenging The Will The Fiduciary Litigator

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

State Estate And Inheritance Taxes Itep

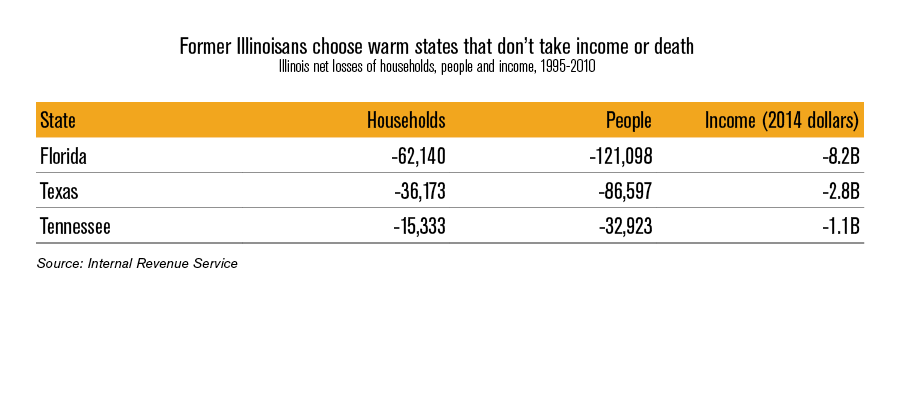

Illinois Should Repeal The Death Tax

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Does Property Passed By Transfer Receive A Step Up In Basis

Taxes And Revenue In Texas Ppt Download

Texas Estate Tax Basics Serving The Community With Integrity And Legal Expertise One Client At A Time